The following is Part III of a multi-part series on value, segmentation and pricing by guest contributor Steven Forth, Partner at Rocket Builders and eFund Member. Read Part I here and Part II here. Also, Steven spoke at a NVBC seminar earlier this year on Choosing a Business Model – catch the video here.

You have found a gap in the market, or maybe a place where a whole new market can blossom. You have brought together some committed people. And there is some money to get to that first take on a minimum viable product.

You have found a gap in the market, or maybe a place where a whole new market can blossom. You have brought together some committed people. And there is some money to get to that first take on a minimum viable product.

So when do you start to think about pricing?

Some will tell you there is no hurry. Your first goal it to get to product-market fit and anything else is secondary. Pricing? You can figure that out later.

This is wrong.

Why? Claims that pricing can be dealt with later turn on a failure to understand both pricing and product market fit.

What is product-market fit?

You have product market fit when your product does a job for a core group of users who share common characteristics (i.e. a market segment). The job is something that they need to have done because it provides some compelling emotional or economic value or because it is habit forming (addictive even).

What is pricing?

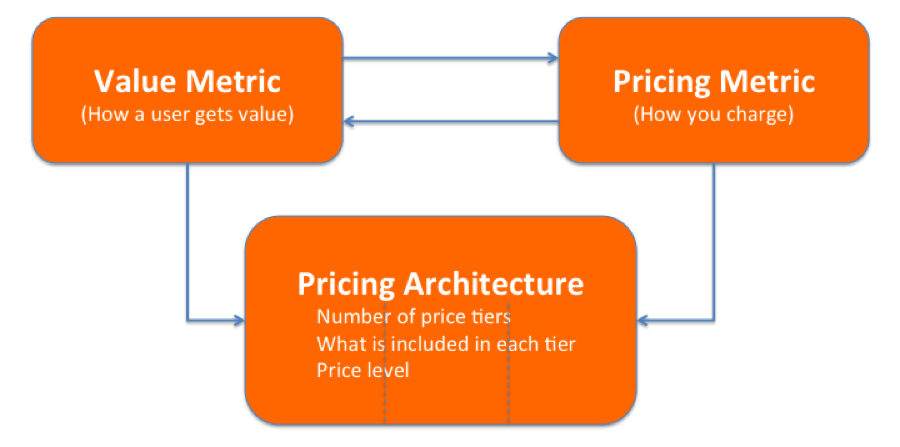

Pricing is how you connect the value you provide with the value you extract. It is at the heart of your business model. Price is a lot more than just a number. Your price is a combination of your:

- value metric (the unit of consumption by which your customer gets value)

- pricing metric (the unit for which you charge),

- pricing architecture (how many offers or tiers you have, what is included in each tier, and pricing level)

- pricing level (yes, you do need to set numbers at some point)

- discount policies (and how you manage them)

That is a lot to think about, but it is all good stuff, because it will determine if you have a viable business.

Only the first three aspects are central to developing a minimum viable product, so that is where I will focus.

Value Metric

The value metric is the unit of consumption that correlates with value to the customer. Failing to understand your value metric is at the root of pricing problems, and the main reason companies fail to achieve product market fit.

A few examples may help.

- When you are painting a room,

- the value metric is the area that a unit of paint will cover.

- When you are buying fuel,

- the value metric is how far the car will go, or how fast it will accelerate.

- When you are buying parking,

- the value metric is a combination of proximity, protection and time.

Ah, that is why the value metric is difficult. In most cases it is a composite of several value propositions (or value drivers as these are often called). And different people may have different weights for each value driver. For some people proximity is most important, for others having a covered parking lot with a guard is what matters most, and for others the ability to leave the car for 24 hours or more is important.

Composite value propositions are the norm today. Some will argue that early-stage companies will do best by focusing on a single, simple value proposition. But there are lots of cases where the innovation is in combing two value propositions that are not normally found together: “comfortable and stylish” or “highly customized and simple” or “just-what-you-want and all-you-can-eat.”

Understanding your value metric is the foundation of pricing. And at the end of the day, only your customers can tell you how and how much value they really get.

Note: All of this becomes even more complex when you have a two-sided market or a platform business. More on this in a future post.

Pricing Metric

Your pricing metric is how you will charge. We are in a golden age of pricing metric innovation. The move to hosting software on-line (services in the cloud), mobile applications and the Internet of Things, the combination of these trends makes all sorts of new pricing models possible. If you can track use you have the option of using this as a pricing metric.

Old confusing models, that had nothing to do with how the user got value, are falling out of fashion. People in IT may remember the old database salesman and his complicated pricing calculator. It is a good thing that these opaque pricing models are disappearing. The closer we can tie a pricing metric to a value metric the faster we can know if we are really getting product market fit.

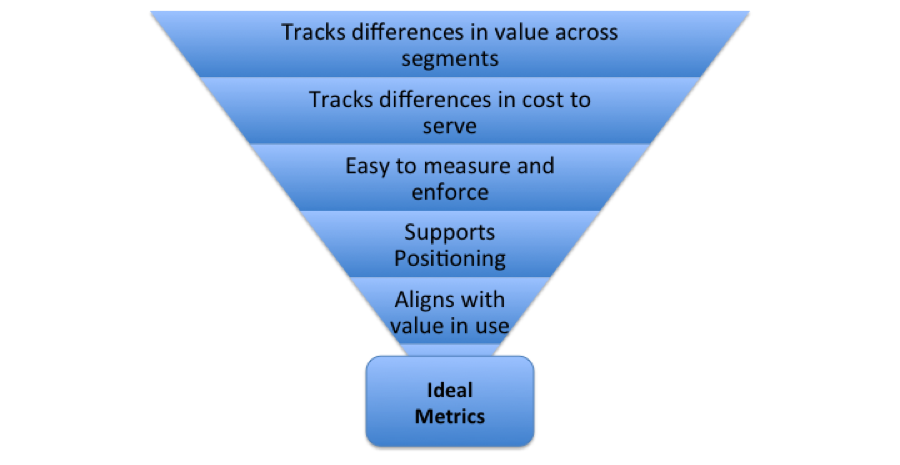

How do you choose a pricing metric? This set of filters is from the classic pricing text The Strategy and Tactics of Pricing by Tom Nagle, John Hogan and Joe Zale (5th Edition page 57). It helps you ask the right questions in the right order.

A good pricing metric

Think of your pricing metric as one place you can innovate. This is especially true if you can find a way to link how your customer gets value to how you get paid. This is what the whole pay-per-click model did for on-line advertising. Advertisers want to know if a person paid attention to their ad. They used to measure ‘impressions’ and they still do this in print and television. But having a user click through provides much stronger evidence of interest and is a more powerful pricing metric. Pricing models based on click-through are eating models based on impressions.

Pricing Architecture

Most companies will end up offering some form of tiered offer. This may be as simple as a free trial and a paid version. Or you may end up with a complex set of offers tailored to each customer’s needs.

Generally you want to start from one side or the other, absolute simplicity or complete customer specificity, and move towards the middle where you will likely have three or four standard offers.

The standard three-tier price architecture works well for many cases. It takes advantage of human psychology (we don’t want to be cheap so we avoid the lowest tier, nor do we want to be spendthrift so we don’t buy the most expensive option either). And having an offer for an individual, a small group, then a business also make sense.

Of course it is not just about setting a price for each tier. It is also important how you fence the tiers and direct people into the tier that best fits them. This is one way to leverage secondary value drivers. You will often have one compelling value driver that you use for your pricing metric, and then a number of secondary metrics that you can use for fencing your tiers.

You may use a per-user pricing metric, but then offer more storage per person at a higher pricing tier. Or the per-person pricing might not include integrations with enterprise software while the enterprise offer comes with integrations built in (but at a higher base price).

Patrick Campbell’s blog Price Intelligently has a lot of great examples of business-to-business (B2B) pricing for software as a service (SaaS). Check out his post on Lessons from the Top Five SaaS Pricing Pages.

Three key thoughts on pricing.

- Pricing is at the center of your business model, it is not something you can leave for later.

- The best pricing is based on how you provide value to your customer and it needs to support your value proposition.

- Pricing and the pricing metric is a place to innovate.

We will be exploring how to use pricing as a leverage point in your go-to-market strategy in Rocket Builder’s Go-to-Market Program. This program is designed for early-stage companies that have initial customers and want to accelerate growth and attract investment.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.