The following is Part II of a multi-part series on value, segmentation and pricing by guest contributor Steven Forth, Partner at Rocket Builders and eFund Member. Read Part I here.

The founder of modern management, Peter Drucker, famously said that the purpose of a company is to create and keep a customer.

The founder of modern management, Peter Drucker, famously said that the purpose of a company is to create and keep a customer.

It is about customers. You can only build a real business if you can get customers and then keep them. And you keep them by providing value.

But what is value? It is one of those words that we use all the time to mean many different things. But in business it means

- The value that you provide to a customer

- Relative to an alternative

The money you spent developing your product or how much it costs to deliver your service is not its value. It’s value to the customer and not the cost to you.

But I still haven’t said what I mean by value. So here we go …

Value is an emotional or economic benefit to the customer. In most cases, emotional value is more important in business-to-consumer (B2C) and economic value is more important in business-to-business (B2B) but in both cases there are cross overs.

It is true that some consumer products are sold primarily on their economic benefits. We often buy at discount stores in order to save money. But let’s face it, we often do this because it makes us feel that we are saving money and not because we are actually adding up all the costs of driving, parking, buying more than we need and those inevitable impulse purchases. Emotions govern consumer purchases.

The best way to understand emotional value in the context of Maslow’s hierarchy of human needs.

Basically, the higher your appeal the higher the price you can realize. Companies that position themselves on self-actualization (Apple comes to mind with its Think Different campaign or locally Lululemon and its manifesto) will command higher prices and higher profits. Companies that pitch themself to appeal to more basic needs will find prices pushed down closer to their costs and will have to make this up on volume (think Wal-Mart). The problem with this is that most start-ups and even most Canadian companies will not be the cost leaders, and competing on cost for basic needs is a tough place to be.

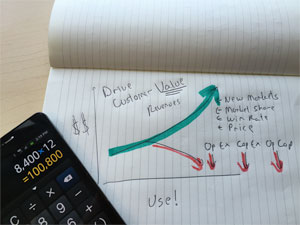

Economics governs B2B. If you are developing a B2B product or service ask yourself “How much money does I make for (for, not from) my customer? You can help your customer make money in different ways.

- Revenue

- Can you help your customer access a new market?

- Do you help them increase market share in an existing market?

- Do you help them win bids against a specific competitor?

- Do you help your customer provide additional value?

- Costs

- Do you reduce costs, not because you are cheap, but because you simplify some part of their business or make it more effective>

- Operating capital

- Do you reduce inventory costs?

- Can you accelerate collections?

- What impact do you have on your customer’s financing costs?

- Capital investment

- Do you help defer a major investment by increasing capacity?

- Do you make the capital asset more effective or less costly?

- Do you help shift costs onto the balance sheet so they can be amortised? (Public companies tend to like this)

Of course, different customers will get values from you in different ways, and in different amounts. This is why value is such a powerful way to segment a market and target customers (see the previous post on Why target market segments). And ideally you want your price, how much you charge, to track how much value your customer is getting (that will be the subject of the next post).

Not everything translates into economic value of course, but in B2B, when you push a little deeper with your customers, you can be surprised just how much actually ties back to the economics. For example, there is no question that brand strength can influence B2B buying decisions. “Nobody ever got fired for buying IBM.”

Ed Arnold, VP Product at my old company LeveragePoint, has a great post on how to quantity intangibles like brand strength. He once told me about a dialog that went sort of as follows:

- Sales Guy: “People buy us because of our brand.”

- Ed: “OK, what is the most important thing about your brand?”

- Sales Guy: “Reliability. Our stud just doesn’t break.”

- Ed: “Why does that matter?”

- Sales Guy: “Our customers rely on us to keep operating. If our stuff breaks then they go down. It can cost them millions.”

- Ed: “So there is an economic benefit. What does it cost a customer when they go down? And how much do you reduce the risk of that happening?”

- Sales Guy: “Huh, I’m not sure, but I can talk to our customers and find out.”

That’s it. Talk to customers and find out. But you have to know what you are trying to find out and that is how much value you provide compared to the alternatives available.

You have to be careful when you talk about customer value. If you Google the term you will find that most results are about how much value the customer provides to the seller. And there are lots of consultants and some software tools that will help you segment your market by the most profitable (to you) customers. This is a great way to refine an established business, but it is a terrible way to think about start-ups.

As a start-up your first job is to figure out how to create differentiated value for a specific group of customers (aka product/market fit).

And then make sure that your unit economics make sense. (Unit economics is the cost of selling something relative to the net revenue you get from selling it.)

So get out there, and have conversations with your customers or target customers about how you provide value. And what the customer sees as the alternatives.

——

Rocket Builders will be coaching growth companies on how to use segmentation to choose a market entry point in the Rocket Builder’s Go-to-Market Program. This program is designed for early-stage companies that have initial customers and want to accelerate growth and attract investment.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.