The following is Part I of a multi-part series on value, segmentation and pricing by guest contributor Steven Forth, Partner at Rocket Builders and eFund Member.

You have your big idea. It is going to change the world. Everyone with a brain will want to use it. And you’ve been told that investors want to see billion dollar markets. So that’s your target market. All those people or companies that will really need what you are bringing to market. Right?

You have your big idea. It is going to change the world. Everyone with a brain will want to use it. And you’ve been told that investors want to see billion dollar markets. So that’s your target market. All those people or companies that will really need what you are bringing to market. Right?

No.

You’ve also heard the term ‘don’t boil the ocean.’ Your marketing team is busy building really well crafted buyer personas. And you are in due diligence with investors who keep on asking you about your target markets.

What is a target market segment? How do you go about choosing one? When do you need to do this?

You choose a market segment before you work on those buyer personas. And you need to have a pretty good picture of your target market in order to seek that elusive ‘product/market fit.’

Segmentation and targeting come in early as you develop your company.

Some people think choosing a segment is something for business to consumer (B2C) companies. And it is true that B2C companies and brands are very good at segmenting markets. The masters of this are the fast moving consumer goods companies. Companies like Coca Cola and Procter & Gamble, and dare I say it, Lululemon. These companies develop fine-grained profiles of consumers, segment them down into market slivers, and test test test their messages. It is a bit of an oversimplification, but one could say that a consumer segment is a group of people who respond in the same way to a message!

So the challenge in consumer markets is to find a message that is focused enough to be effective and broad enough to deliver to a great many people. The most effective messages are individual and part of conversations that build trust. A series of messages supports the whole process of consideration, trial, adoption, recommendation. But even with social media it is hard to have an individual conversation with every consumer. So you have to develop segments. This is a test driven process, with a lot of A/B experimentation and multivariate analysis. You need a lot of data to do this, but then there are a lot of consumers out there. Sound hard? It is. B2C markets are hard and usually take a lot of money to develop and serve at any scale. But they are the largest markets.

And business-to-business markets (B2B) are learning a lot about segmentation from B2C. The most important lessons have been that segmentation has to include how you communicate and that segments are based on data. But B2B market segments differ from B2C segments because the compelling reason to buy is different in B2B. In B2B one must factor in economic value.

Economic Value: How does your customer get economic benefit from your solution compared to the alternative?

In B2B, a good segment is one where (i) the targets get value from you in the same way and (ii) the targets have a similar buying process. In some cases there is a third consideration. Will customers recommend you to their peers (or in technical jargon, do buyers in the segment cross reference). For a small company, having your customers recommend you to other customers is a huge plus.

There are really just four ways to deliver economic value for your customers:

- Increase revenues

- Decrease operating costs

- Decrease working capital requirements

- Decrease capital spending requirements

Companies who buy because you are increasing their revenues are probably different from the ones who are buying because you decrease their costs. In any case, the person making the buying decision is almost certainly different. These companies are in different segments. The intersection of how and why people buy and your value proposition is central to segmentation.

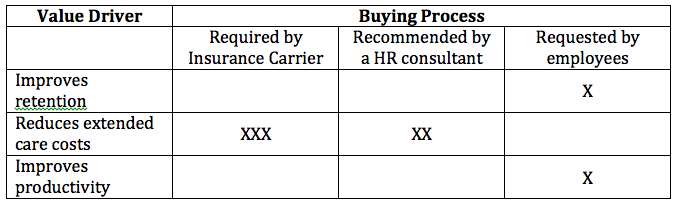

Highly simplified, an initial segmentation matrix for a new human resources application that reduces employee stress might look like this.

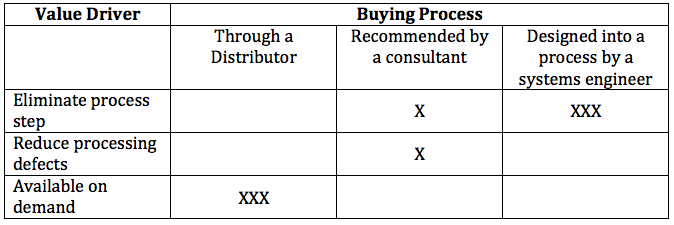

The segmentation matrix for a new material might look like this.

You develop your matrix in parallel with identifying customers. For each new customer, figure out how they are getting value and how they worked through their buying process. Eventually you will see a pattern emerge and your target segments will become clear.

As a small company, you want to be in one segment. The segment should be big enough for you to get traction and support your growth, but small enough that you can dominate it. Once you have a strong presence in one segment, go on to the next.

Here are some things you can do to get a better understanding of how to do segmentation.

In the market for a new iPhone?

Ask yourself, are you in the segment Apple is targeting for the iPhone 5, the iPhone 6 or the iPhone 6+ (the phablet).

How is Apple targeting each segment? Are their messages resonating with you? Is that because they got the message wrong or because you are not in the segment the message is targeted at? How does Apple avoid message conflict as it goes after each of these segments (and it does want people in all three segments).

Need to do a quick segmentation early in development?

- Write down three of your value propositions. (A value proposition is a simple statement of how a customer gets value from using your product or service. It can have emotional and economic components.)

- Write down three possible segments.

- Go out and test each message with three customers or potential customers in each segment.

That gives you 27 data points, enough to get started.

How do you test your value proposition? Not by talking to your team, your advisors, your consultants or competitors. You have to go out and talk to customers. Find out if they agree with your value proposition. They agree if they say they would buy if convinced you can deliver the value you claim.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.

Steven Forth is a Vancouver consultant, investor and serial entrepreneur. He is a partner at Rocket Builders where his work is focused on market strategy including market segmentation, pricing and the design of revenue generation systems. He invests through eFund where he occasionally leads due diligence teams. His newest venture is Nugg, a VentureLabs start-up building a platform for team building and collaboration.